Make Your Money Work Harder: Top Tools for Passive Income Beginners

That image of money appearing in your account while you’re busy living your life has a powerful pull. It suggests a kind of financial autopilot. For most people, turning that idea into something tangible feels confusing. The path seems clogged with complicated terms and methods that don’t make much sense for a regular person.

The reality is more about mechanics.

Think of it as setting up a small, quiet machine in the corner of your financial life. This machine needs some assembly. You have to find the pieces and fit them together correctly. A handful of newer services act like a pre-sorted toolkit for this job. They remove the guesswork, giving you the specific parts you need. What felt like a distant target becomes a short list of clear actions.

Your Toolbox for Building Income Engines

Think of these platforms as different types of mechanics for your financial future. Each one offers a specific set of tools, whether you’re learning how an engine works, automating the fuel line, or building a completely new component.

Finelo: The Foundation Builder

Finelo.com approaches passive income from the ground up, focusing on the education needed before you invest a single dollar. Its strength lies in breaking down complex strategies into clear, structured lessons.

You’ll find dedicated courses on building passive income streams, covering everything from dividend investing to the basics of real estate. The platform’s investing simulator is particularly useful here, giving you a virtual $10,000 to test out income-generating strategies with real-market data.

This allows you to practice building a portfolio that pays out dividends or interest, all without the risk of using your actual savings. It’s the equivalent of a flight simulator for your finances, ensuring you understand the controls before you take off for real.

Fundrise: The Real Estate Simplifier

Fundrise removes the landlord from the real estate equation. You won’t get calls about leaky pipes or need to find someone to rent a room. The service collects funds from you and many others, then uses that collective pool to invest in large-scale property projects, such as apartment complexes or commercial buildings.

Your initial investment can be quite modest. In return, you get a small piece of everything they own. You might see money from tenant rent payments showing up in your account every few months.

You also stand to gain if the value of those buildings goes up over time. It lets you have a stake in property without the typical headaches, shifting your relationship with real estate from someone who pays rent to someone who collects it.

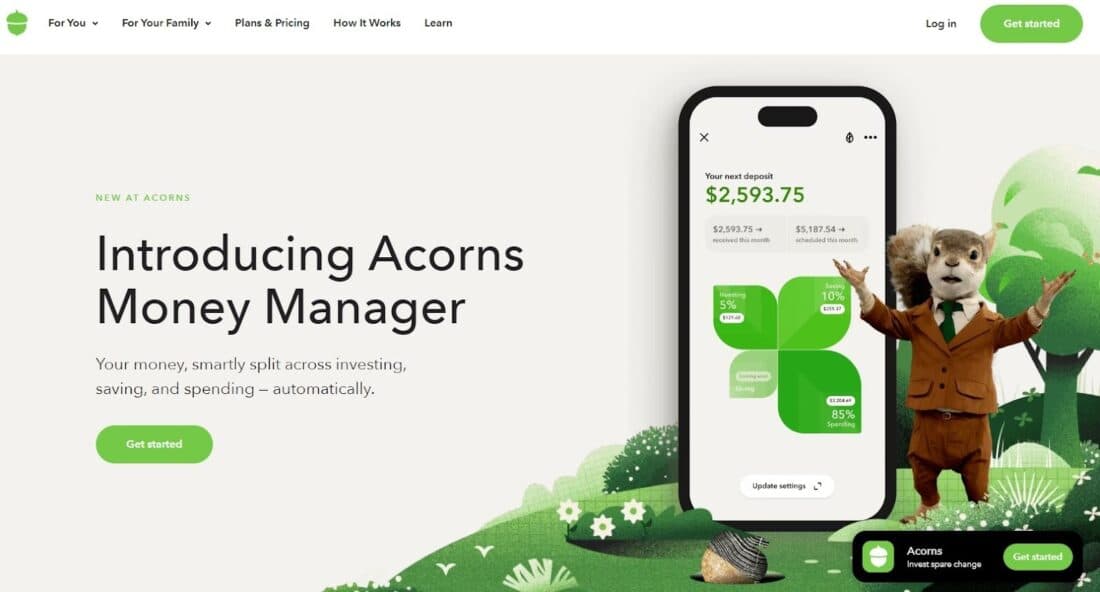

Acorns: The Micro-Investing Automator

Acorns believes the money you don’t even notice can become something significant. Connect your cards, and the app watches your transactions.

Every time you buy something, it rounds up the total and sets that extra change aside. A sandwich for $8.40 means $0.60 gets quietly moved into an investment account. This account holds a mix of ETFs, which are like pre-made baskets of stocks.

You can also tell it to pull a fixed amount from your bank each week. The whole thing runs in the background. It turns the forgotten fragments of your daily spending into a slow, steady build of investments.

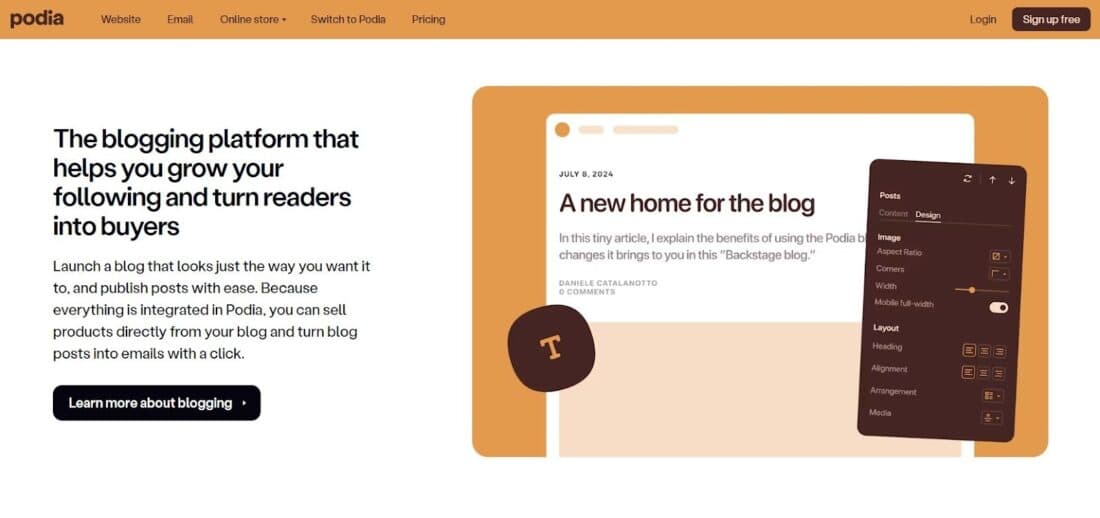

Podia: The Digital Product Workshop

Podia works like a digital storekeeper for your ideas. The service gives you a single space to build and sell things that don’t need physical shipping. You can film a series of lessons, write a guide, or start a paid group, and Podia handles the entire setup.

Unlike piecing together a website with separate tools for payments, email, and hosting, Podia bundles everything. You can upload your course videos, write your sales page, and start accepting payments through a single, straightforward interface. This removes the technical friction that often stops creators.

Once your digital product is built and listed, the platform handles the delivery automatically. Every sale after that is largely passive, allowing you to earn from work you did once, long after it’s finished.

Shifting Your Money Mindset

Many people get stuck at the starting line because they’re waiting for a large lump sum to invest. They picture needing thousands of dollars to buy a rental property or a significant stock portfolio. This all-or-nothing thinking is the biggest roadblock.

The modern approach to building income is different. It’s less about a single large deposit and more about creating small, automated channels that feed into your financial future. The platforms we’ve discussed are designed for this exact purpose. Your focus shouldn’t be on the amount, but on the system itself.

Whether it’s Acorns quietly collecting your digital spare change or Fundrise letting you own a piece of an apartment building for the price of a nice dinner, the barrier to entry has been dismantled. The first step isn’t about making a big move; it’s about choosing which small, automatic trickle you want to start first.

Moving From the Bleachers to the Field

A lot of people get stuck just reading and watching. They never move from thinking about it to trying something. This shift is the entire challenge.

You can’t figure out how to ride a bike by watching other people do it. You have to get in the shallow end. Your first action should feel like that—getting into the water, not jumping into the deep end. This could mean using Finelo’s simulator to “invest” in dividend stocks for a few weeks without any real money. It could mean setting up a Podia account and uploading a single, short PDF guide, just to see how the process works from creation to a mock sale.

This first try is about taking the mystery out of the process. Clicking around a practice account or building a simple product page shows you where everything is. The unknown becomes familiar. That confusion about what to do next gets replaced with a clear picture of your own path forward.

Wrapping Up

The word “passive” sets some pretty wrong expectations. It suggests the work happens by itself. A more accurate description might be “front-loaded” income. These platforms excel at reducing that initial effort, making the path clearer and the first steps simpler.

You won’t see much for a while. The meaningful changes happen later. Small, regular investments or a trickle of online sales start to add up in a way that isn’t obvious at first. Your main task is picking a direction and making a beginning.

Select a service that fits what you want to create, do the first thing it asks for, and then let the routine it establishes carry on without your constant attention.